AAVE Faces Critical Support Test Amid Sharp Intraday Reversal

AAVE has seen a significant price drop after failing to maintain support at $175–176, now trading in the mid-$150s. Traders are closely watching if buyers can defend this crucial zone amid a surge in selling pressure.

Key Takeaways

- 1## Sharp Intraday Reversal Tests AAVE Support Levels AAVE, a prominent contender in the decentralized finance (DeFi) space, has encountered a sharp sell-off, prompting traders and analysts alike to reassess the strength of its support levels.

- 2The recent volatility in AAVE's price action raises critical questions about buyer resilience and the potential for recovery.

- 3## Price Movement and Technical Breakdown Recently, the digital asset faced significant selling pressure in the $175–176 zone, which catalyzed a sharp downturn that saw prices plunge toward the mid-$150s.

- 4This steep decline represents a noteworthy shift in intraday market structure, indicating a possible break in the bullish momentum that AAVE had built in recent weeks.

- 5The rapid drop illustrates a surge in selling momentum, as AAVE relinquished multiple percentage points following a failure to hold the key $175–176 support zone.

Sharp Intraday Reversal Tests AAVE Support Levels

AAVE, a prominent contender in the decentralized finance (DeFi) space, has encountered a sharp sell-off, prompting traders and analysts alike to reassess the strength of its support levels. The recent volatility in AAVE's price action raises critical questions about buyer resilience and the potential for recovery.

Price Movement and Technical Breakdown

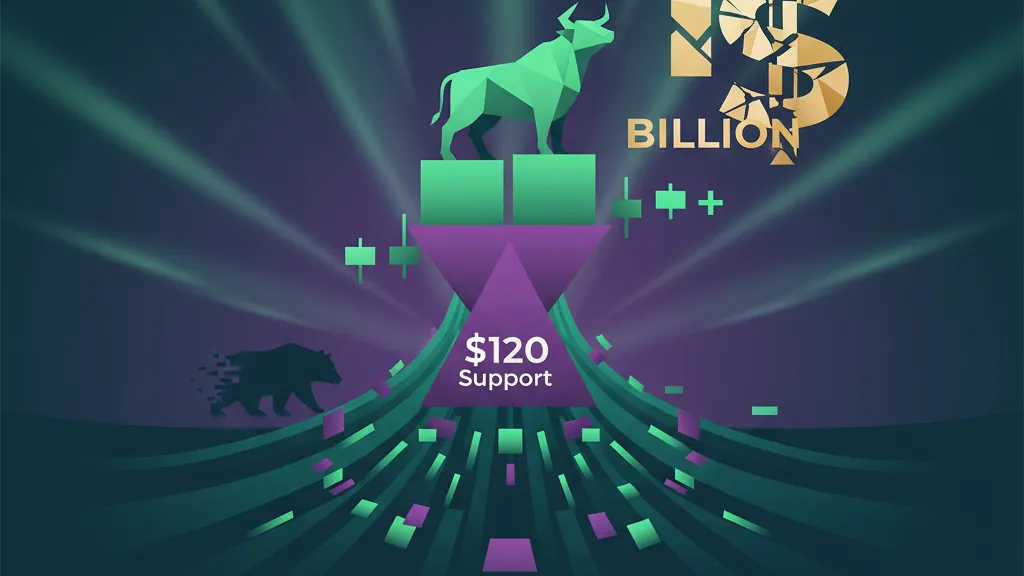

Recently, the digital asset faced significant selling pressure in the $175–176 zone, which catalyzed a sharp downturn that saw prices plunge toward the mid-$150s. This steep decline represents a noteworthy shift in intraday market structure, indicating a possible break in the bullish momentum that AAVE had built in recent weeks.

The rapid drop illustrates a surge in selling momentum, as AAVE relinquished multiple percentage points following a failure to hold the key $175–176 support zone. This area, once of great interest to market participants, has now transformed into a pivotal point for price action, highlighting the bearish sentiment gathering pace in the market.

Current Market Positioning

As AAVE settles in the mid-$150 range, the focus now shifts to whether buyers can muster enough strength to defend this critical support zone. This level has transformed into a battleground between bullish and bearish forces, making it paramount for determining the altcoin's near-term directional bias.

The breakdown from higher price levels has altered the technical landscape significantly. Market observers are eagerly monitoring how AAVE behaves at these current prices, questioning if we will see accumulation or if escalating selling pressure will push prices lower.

Implications for Traders

The recent structural revisions in AAVE’s price action carry profound implications for both day traders and long-term holders. The inability to sustain higher prices signals potential vulnerabilities in the asset's momentum, while the mid-$150s could serve as a critical support threshold for buyer conviction.

For traders tracking AAVE's price movements, the upcoming sessions will be crucial. The manner in which AAVE interacts with the mid-$150 range will likely indicate whether a base can form for stabilization or if further downside is imminent.

Conclusion

AAVE's recent market dynamics reveal a decisive structural shift, plummeting from the $175–176 realm down to the mid-$150s. The quest for sustainability at these levels remains uncertain, with participants keenly observing if buyers can defend this crucial juncture or if an even steeper decline is on the horizon.

Why It Matters

Traders

For short-term traders, the price movement highlights a critical testing point for transactions; understanding the potential for recovery or additional losses is essential for informed decision-making.

Investors

Long-term investors should consider the implications of the intraday reversal on AAVE's overall momentum. Sustaining levels in the mid-$150s could provide a buying opportunity, while further declines might signal a need to reassess holdings.

Builders

For developers and builders in the DeFi ecosystem, the fluctuations in AAVE's price can impact the broader market sentiment. It’s crucial to monitor these changes to strategize projects and contributions that align with the changing landscape.