AAVE Faces Critical Support Test Amid Sharp Price Decline

AAVE has seen a dramatic price pullback, raising concerns about its ability to maintain key support levels. As it retreats from recent highs, market participants are on alert for signs of buying pressure in the midst of this volatility.

Key Takeaways

- 1## Sharp Decline Tests AAVE Support Levels AAVE, one of the leading decentralized finance (DeFi) protocols, has witnessed a steep price correction in recent trading sessions, igniting discussions about the sustainability of its current support levels.

- 2Following a strong performance that saw AAVE approach the $175-$176 zone, the digital asset has sharply retreated, marking a significant shift in its short-term market dynamics.

- 3## Price Action Breakdown The sell-off initiated from the $175-$176 region, where AAVE had been consolidating prior to the downturn.

- 4In a swift manner, the asset lost momentum, sliding down to the mid-$150 range.

- 5Traders are now describing this decisive move as a critical alteration of the token's intraday technical structure.

Sharp Decline Tests AAVE Support Levels

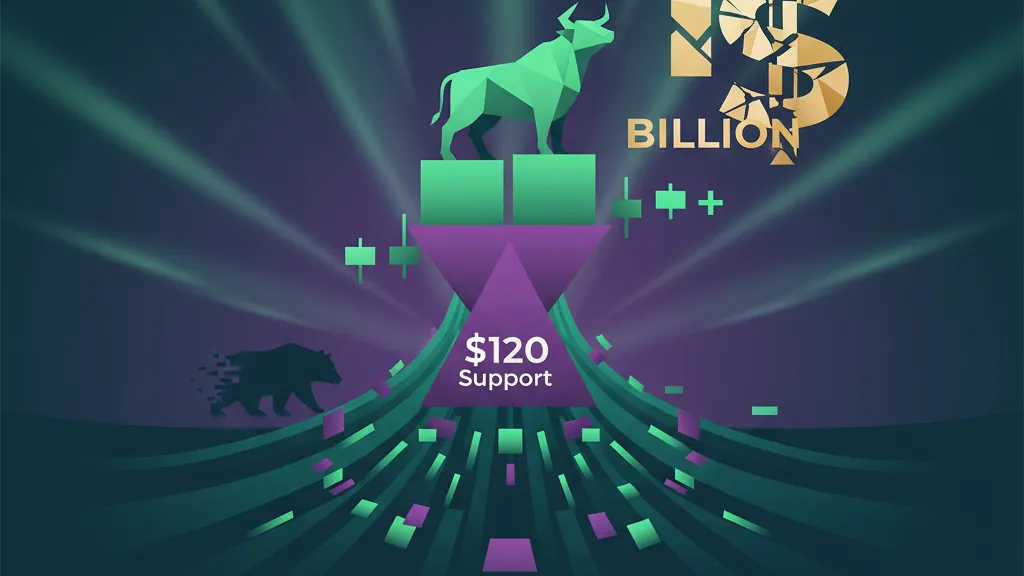

AAVE, one of the leading decentralized finance (DeFi) protocols, has witnessed a steep price correction in recent trading sessions, igniting discussions about the sustainability of its current support levels. Following a strong performance that saw AAVE approach the $175-$176 zone, the digital asset has sharply retreated, marking a significant shift in its short-term market dynamics.

Price Action Breakdown

The sell-off initiated from the $175-$176 region, where AAVE had been consolidating prior to the downturn. In a swift manner, the asset lost momentum, sliding down to the mid-$150 range. Traders are now describing this decisive move as a critical alteration of the token's intraday technical structure.

This price movement reflects a meaningful correction from previous ranges, with AAVE shedding approximately 10-12% of its value during the decline. The rapidity of this sell-off has led to heightened concerns among market participants regarding the potential for buying pressure to materialize at current levels.

Technical Structure Shift

Following the recent sell-off, AAVE's technical structure has seen considerable transformation. The breakdown from the $175-$176 area indicates that prior support may now act as potential resistance—an established pattern following sharp declines.

Currently, the mid-$150s range stands as a critical test zone for the asset. This area will determine whether buyers possess the conviction to defend current prices and attempt a recovery, or if further downside pressures are anticipated.

Market Implications

The current price action presents a pivotal crossroads for both AAVE holders and prospective investors. If buyers can establish a floor in the mid-$150 range, it could indicate renewed confidence in the asset, possibly paving the way for stabilization.

In contrast, a failure to maintain this support may lead to increased downward pressure as traders reassess their positions and risk management strategies. Monitoring volume and buying activity at these critical levels will serve as essential indicators of market sentiment in the near term.

Conclusion

AAVE's recent price decline from the $175-$176 range to the mid-$150s represents a significant technical evolution that has reshaped the token's short-term outlook. The ensuing contests at this support zone will profoundly reflect buyer commitment, with market participants keenly observing whether a new support level can be established, or if additional weakness awaits. The next few sessions are likely to clarify AAVE's directional path.

Why It Matters

Traders

Traders should closely monitor the mid-$150s support level, as its stability could dictate short-term trading strategies. Increased volume or buying activity could signal a rebound, while further declines may lead to reassessment of positions.

Investors

For long-term investors, the current downturn provides an opportunity to evaluate AAVE's fundamentals against its price action. Establishing support may indicate that the project remains robust despite market fluctuations.

Builders

Developers and builders in the DeFi space must watch AAVE's movements as it is a key player impacting market sentiment. The health of AAVE can influence broader market dynamics and development opportunities across various protocols.