AAVE Targets $190 Recovery by 2025 Amid Market Challenges

As AAVE faces bearish pressure, analysts forecast a potential recovery to $190 by January 2025. Key support levels highlight both risks and opportunities for traders and investors alike.

Key Takeaways

- 1## AAVE Targets $190 Recovery by 2025 Amid Market Challenges AAVE, one of the leading decentralized finance (DeFi) lending protocols, is encountering pivotal market challenges as analysts project a promising recovery to $190 by January 2025, despite the token currently contending with bearish conditions.

- 2## Current Market Position and Key Support Levels The immediate trading outlook for AAVE revolves around a critical support level at $146.

- 340.

- 4This price point serves as a significant threshold, pivotal in determining the token's short-term trajectory.

- 5Technical analysis suggests that maintaining this support level is essential for any potential upward movement toward the projected $190 target.

AAVE Targets $190 Recovery by 2025 Amid Market Challenges

AAVE, one of the leading decentralized finance (DeFi) lending protocols, is encountering pivotal market challenges as analysts project a promising recovery to $190 by January 2025, despite the token currently contending with bearish conditions.

Current Market Position and Key Support Levels

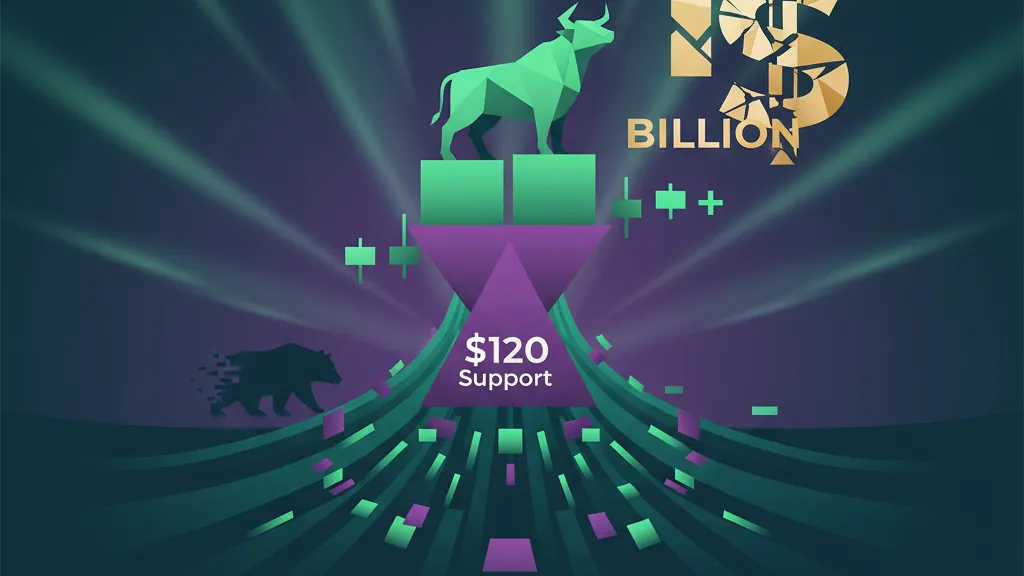

The immediate trading outlook for AAVE revolves around a critical support level at $146.40. This price point serves as a significant threshold, pivotal in determining the token's short-term trajectory. Technical analysis suggests that maintaining this support level is essential for any potential upward movement toward the projected $190 target.

Should AAVE fail to hold above the $146.40 support, analysts foresee a possible decline to the $135 range—a secondary support zone that could lead to a more substantial correction and test investor confidence in the near term.

Recovery Outlook Despite Headwinds

The optimistic $190 recovery target for January 2025 highlights a potential rebound that stands in stark contrast to the current bearish momentum affecting AAVE. This projection implies a significant recovery from present levels, indicating that key fundamental or technical factors may drive a reversal in the upcoming months.

The timeline extending to January 2025 offers a multi-week horizon for this anticipated recovery, suggesting that any upward movement may occur gradually rather than immediately.

Market Implications

For current AAVE holders and potential investors, the existing market dynamics present both risk and opportunity. The identified support levels act as critical decision points for traders managing their positions, with the $146.40 level likely to attract increased trading volume as market participants scrutinize the ability of buyers to defend this price point.

Moreover, the broader DeFi sector's performance and overall cryptocurrency market sentiment will significantly influence whether AAVE can realize its projected recovery target. As a cornerstone of the DeFi landscape, AAVE's price action often reflects investor confidence in decentralized lending platforms and their ability to sustain user adoption and total value locked (TVL).

Conclusion

AAVE stands at a pivotal juncture as it navigates current bearish pressures, yet it retains the potential for significant recovery by early 2025. The immediate focus rests on key support levels, with the $146.40 threshold marking the first line of defense against further downside movements.

Why It Matters

For Traders

Traders should keep a close eye on the $146.40 support level, as defending this price point may present opportunities for initiating long positions amid potential rebounds.

For Investors

Long-term investors can look at the projected $190 recovery target as a signal of potential gains in a volatile market, making AAVE a notable asset for future consideration.

For Builders

Developers and builders in the DeFi space might find AAVE's continued developments and possible recovery to $190 insightful, guiding investment in technologies or projects aligned with decentralized lending growth.