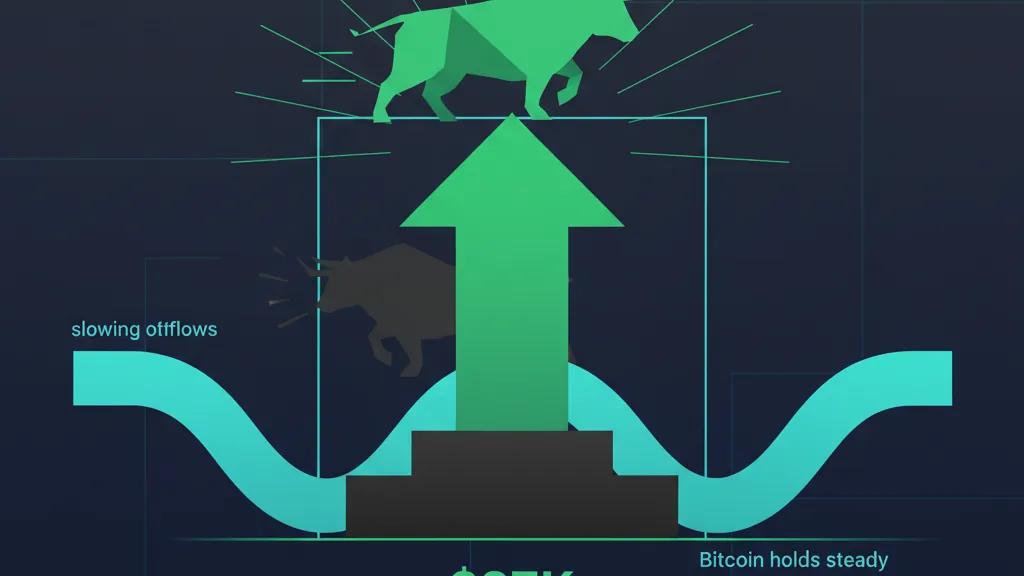

Bitcoin Holds Steady at $87K as ETF Outflows Begin to Slow

Bitcoin's price remains stable around $87,000 as institutional ETF outflows show the first signs of slowing since December, hinting at a potential shift in market sentiment.

Key Takeaways

- 1## Bitcoin Holds Steady at $87K as ETF Outflows Begin to Slow Bitcoin's price action remained relatively flat on Tuesday, hovering near the $87,000 mark as the cryptocurrency market observed a notable shift in institutional investment flows.

- 2For the first time in nearly two months, outflows from spot Bitcoin exchange-traded funds (ETFs) showed signs of deceleration, potentially signaling a change in sentiment among institutional investors.

- 3## ETF Outflows Show First Signs of Slowdown According to data from SoSoValue, the 12 spot Bitcoin ETFs recorded a combined net outflow of $19.

- 429 million on Tuesday.

- 5Although this still reflects negative flows, it indicates a significant reduction in selling pressure compared to recent weeks.

Bitcoin Holds Steady at $87K as ETF Outflows Begin to Slow

Bitcoin's price action remained relatively flat on Tuesday, hovering near the $87,000 mark as the cryptocurrency market observed a notable shift in institutional investment flows. For the first time in nearly two months, outflows from spot Bitcoin exchange-traded funds (ETFs) showed signs of deceleration, potentially signaling a change in sentiment among institutional investors.

ETF Outflows Show First Signs of Slowdown

According to data from SoSoValue, the 12 spot Bitcoin ETFs recorded a combined net outflow of $19.29 million on Tuesday. Although this still reflects negative flows, it indicates a significant reduction in selling pressure compared to recent weeks. Notably, this marks the first measurable deceleration in ETF outflows since December 18, effectively breaking a prolonged streak of increased withdrawals.

The spot Bitcoin ETF market has garnered close attention since these investment vehicles launched, serving as a key indicator of institutional sentiment toward the cryptocurrency. The recent period of sustained outflows had raised alarm among market observers regarding weakening institutional demand for Bitcoin.

Market Implications

The stabilization of Bitcoin's price, coupled with moderating ETF outflows, suggests a possible shift in market dynamics. Reduced selling pressure from institutional channels may create a more stable foundation for price movements in the near term. However, the persistence of net outflows, albeit at a slower rate, indicates that some institutional investors are still reducing their Bitcoin exposure. The $19.29 million in outflows—though smaller than previous figures—still represents a net negative flow that could cap any upside momentum.

Conclusion

Bitcoin's consolidation near $87,000, in tandem with the first slowdown in ETF outflows since mid-December, presents a mixed picture for the cryptocurrency market. While the reduced pace of institutional withdrawals may alleviate some downward pressure, the ongoing net outflows suggest that caution remains prevalent among professional investors. Market participants will be closely monitoring whether this deceleration signals a mere temporary pause or the onset of a trend reversal in institutional flows.

Why It Matters

For Traders

The trend of ETF outflows could inform short-term trading strategies, as understanding the behavior of institutional investors may provide insights into potential price movements.

For Investors

Long-term investors may view the deceleration in outflows as a potential signal of renewed interest or stability in institutional demand, which could bode well for Bitcoin's price trajectory.

For Builders

Developers and builders in the crypto space may see this stabilization as an opportunity to focus on innovation and projects that enhance the ecosystem, knowing that market sentiment could be shifting positively.