China Reiterates Crypto Ban Amid Crackdown on Yuan Stablecoins

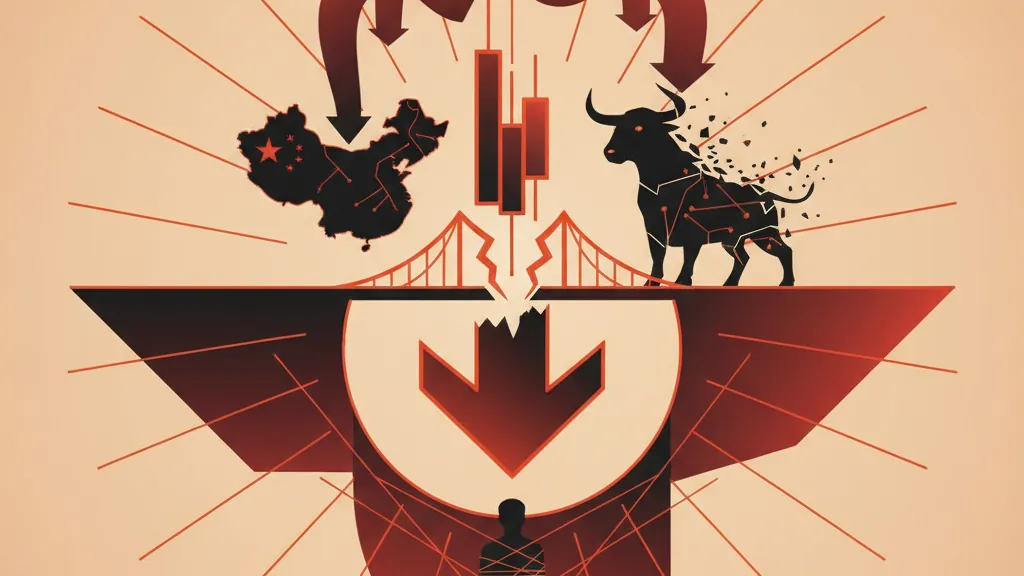

China has reaffirmed its long-standing ban on cryptocurrencies while intensifying its crackdown on tokenized assets and Yuan-backed stablecoins. This move highlights the government's commitment to controlling digital finance and ensuring financial stability.

Key Takeaways

- 1## China Reiterates Crypto Ban While Cracking Down on Tokenized Assets and Yuan Stablecoins China has once again affirmed its longstanding ban on cryptocurrencies, a move that reflects the government's continued resolve to control the digital asset landscape within its borders.

- 2In recent developments, authorities have intensified their crackdown on various tokenized assets and are now focusing on the regulation of Yuan-backed stablecoins, indicating a broader strategy to maintain financial stability and limit speculative activities in the market.

- 3### The Ban on Cryptocurrencies China first imposed a sweeping ban on cryptocurrencies in 2017, stating that activities related to Initial Coin Offerings (ICOs) and cryptocurrency trading were illegal.

- 4Despite previous attempts to relax some restrictions, the government has maintained a hardline stance.

- 5Recent declarations from state regulators reaffirm this position, stating that activities involving cryptocurrency trading platforms and the sale of cryptocurrencies remain prohibited.

China Reiterates Crypto Ban While Cracking Down on Tokenized Assets and Yuan Stablecoins

China has once again affirmed its longstanding ban on cryptocurrencies, a move that reflects the government's continued resolve to control the digital asset landscape within its borders. In recent developments, authorities have intensified their crackdown on various tokenized assets and are now focusing on the regulation of Yuan-backed stablecoins, indicating a broader strategy to maintain financial stability and limit speculative activities in the market.

The Ban on Cryptocurrencies

China first imposed a sweeping ban on cryptocurrencies in 2017, stating that activities related to Initial Coin Offerings (ICOs) and cryptocurrency trading were illegal. Despite previous attempts to relax some restrictions, the government has maintained a hardline stance. Recent declarations from state regulators reaffirm this position, stating that activities involving cryptocurrency trading platforms and the sale of cryptocurrencies remain prohibited.

Targeting Tokenized Assets

In addition to focusing on traditional cryptocurrencies, Chinese authorities are also signaling a crackdown on tokenized assets. These digital assets, tied to real-world assets, have gained traction globally as a means to enhance liquidity and access to investment opportunities. By targeting these new forms of digital currency, the Chinese government aims to eliminate potential pathways for evading existing regulations while also protecting investors from scams and unsanctioned financial products in a rapidly evolving digital finance landscape.

The Spotlight on Yuan Stablecoins

Perhaps most noteworthy in recent announcements is the government's increased scrutiny of Yuan stablecoins. These digital currencies, pegged to the Chinese Yuan, were anticipated as key innovations for expanding the utility of China's digital currency ecosystem. However, with recent regulatory interventions, it seems the government is seeking to limit their growth to ensure any form of digital currency remains firmly under its control. This comes at a time when the People’s Bank of China is working to roll out its central bank digital currency (CBDC), the digital yuan, as part of its modernization efforts in monetary policy and financial transactions.

Why It Matters

For Traders

The reaffirmation of the crypto ban and the crackdown on tokenized assets mean traders may face heightened uncertainty and volatility in the markets. As regulatory scrutiny increases, traders should exercise caution and stay informed about the evolving regulatory landscape to avoid potential pitfalls.

For Investors

Investors targeting Chinese markets or seeking exposure to digital assets may need to recalibrate their strategies. China's firm stance against crypto and tokenized assets can lead to significant market disruptions, making it critical for investors to stay abreast of policy changes.

For Builders

For developers and companies in the blockchain space, these developments signal the need for adaptive strategies and innovative approaches. Builders focused on compliant and regulated financial products may find new opportunities, while those relying on traditional cryptocurrency models could face significant challenges ahead.

Entities: China, Yuan

Categories: Cryptocurrency, Regulation