DTCC Aims to Digitally Enable 1.4 Million Securities: What It Means

The DTCC is on a mission to digitize all 1.4 million securities in its custody, revolutionizing capital markets. This initiative promises to enhance trading efficiency and open new investment opportunities.

Key Takeaways

- 1## DTCC Aiming to Make All 1.

- 24 Million Securities in Its Custody Digitally Eligible The Depository Trust & Clearing Corporation (DTCC), a crucial entity in the financial services landscape, has unveiled an ambitious plan to make all 1.

- 34 million securities under its custody digitally eligible.

- 4This significant move stands to redefine the tokenization landscape within capital markets.

- 5### The Push for Digital Eligibility In a recent announcement, Brian Steele from DTCC outlined the company's vision for a digital transformation in the securities market.

DTCC Aiming to Make All 1.4 Million Securities in Its Custody Digitally Eligible

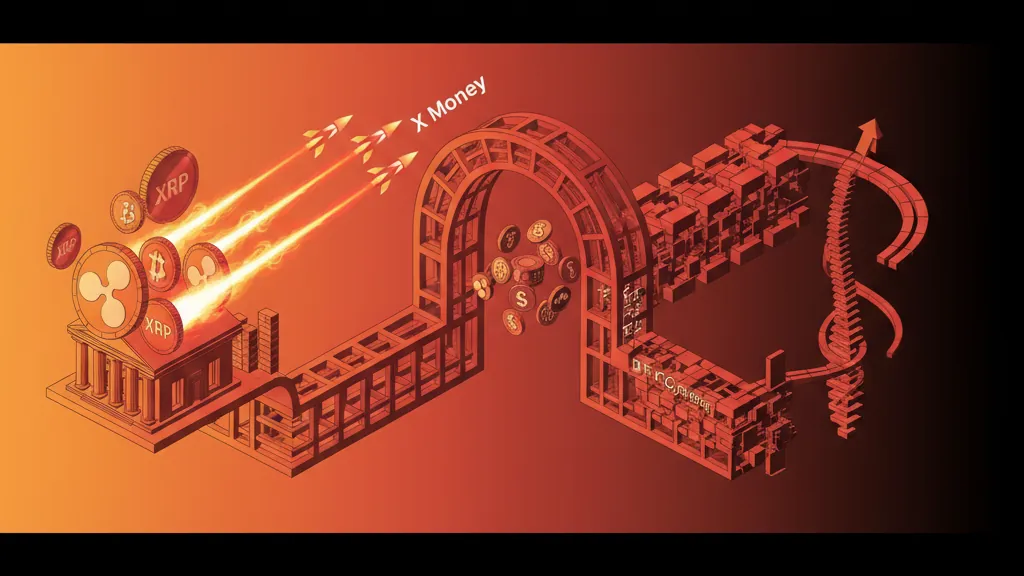

The Depository Trust & Clearing Corporation (DTCC), a crucial entity in the financial services landscape, has unveiled an ambitious plan to make all 1.4 million securities under its custody digitally eligible. This significant move stands to redefine the tokenization landscape within capital markets.

The Push for Digital Eligibility

In a recent announcement, Brian Steele from DTCC outlined the company's vision for a digital transformation in the securities market. The initiative aims not only to boost the efficiency of settlements and transactions but also to promote innovation in the utilization of securities in a digital format. With its robust infrastructure already managing a diverse array of tradable assets, DTCC's focus on digital eligibility could unlock new opportunities for both investors and companies.

The drive toward digitization aligns with a broader trend across multiple sectors, where organizations are leveraging blockchain technology to enhance transparency, security, and processing speed. By establishing a framework for digital assets, DTCC positions itself at the cutting edge of capital market evolution.

What This Means for the Industry

For Traders

For traders, the digital eligibility of securities could streamline trading processes, reduce transaction times, and mitigate settlement risks. Digital tokens representing securities can facilitate quicker trades, potentially leading to more efficient markets. Enhanced transparency also fosters trade confidence, as digital records are immutable and traceable.

For Investors

Investors can look forward to increased access to a broader array of investment opportunities. With DTCC's push for digital eligibility, traditional securities are set to seamlessly integrate with digital platforms, allowing for easier portfolio diversification. Moreover, innovations in tokenization may introduce fractional ownership options, making high-value securities more accessible to retail investors.

For Builders

For tech builders, this initiative opens a wealth of opportunities to create new applications and services tailored to a digital securities landscape. Integrating blockchain technology into standard operating procedures can inspire a variety of fintech solutions aimed at improving operational efficiency and streamlining compliance in capital markets.

Conclusion

As DTCC embarks on its journey to make its extensive portfolio of securities digitally eligible, the implications reverberate throughout the financial ecosystem. While transitioning to digitized assets may pose certain challenges, the potential rewards stand to significantly reshape trading, investing, and building dynamics within capital markets. Stakeholders will be closely monitoring how DTCC's strategies evolve and what innovative advancements may arise from this transformative journey.

Why It Matters

For Traders

Streamlines trading processes and reduces risks.

For Investors

Expands investment options and enhances portfolio diversification.

For Builders

Unlocks new opportunities for fintech innovations.