Emergency Liquidity Measures Highlight Intensifying Market Strain

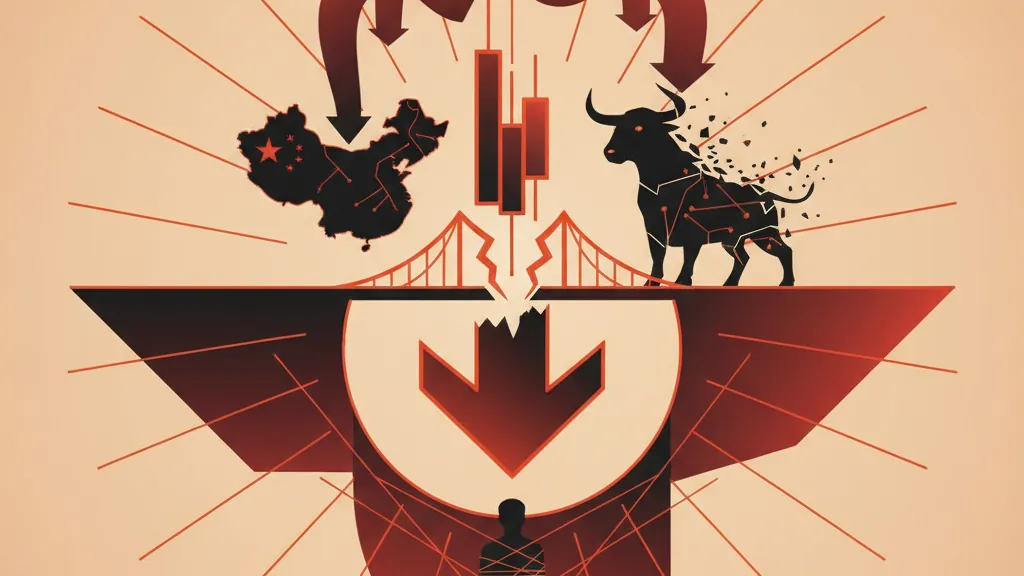

Central banks' emergency liquidity operations raise alarms over financial market stability. The Fed and PBOC's unprecedented interventions signal potential warning signs of a looming liquidity crisis.

Key Takeaways

- 1# Emergency Liquidity Measures Highlight Intensifying Market Strain Central banks on both sides of the Pacific have implemented significant emergency liquidity operations, raising concerns about underlying stress in global financial markets.

- 2Both the Federal Reserve and the People's Bank of China (PBOC) have instituted unprecedented measures this week, signaling a possible turning point for market stability.

- 3## Record Fed Intervention Through Standing Repo Facility The Federal Reserve recorded a staggering $74.

- 46 billion deployment through its Standing Repo Facility—the highest single-day utilization since the facility's inception.

- 5Financial institutions pledged $43.

Emergency Liquidity Measures Highlight Intensifying Market Strain

Central banks on both sides of the Pacific have implemented significant emergency liquidity operations, raising concerns about underlying stress in global financial markets. Both the Federal Reserve and the People's Bank of China (PBOC) have instituted unprecedented measures this week, signaling a possible turning point for market stability.

Record Fed Intervention Through Standing Repo Facility

The Federal Reserve recorded a staggering $74.6 billion deployment through its Standing Repo Facility—the highest single-day utilization since the facility's inception. Financial institutions pledged $43.1 billion in mortgage-backed securities alongside $31.5 billion in Treasuries as collateral to gain access to this emergency funding.

The composition of this collateral has caught the attention of market analysts. The high proportion of mortgage-backed securities in comparison to Treasuries marks an unusual trend, as banks typically prefer to pledge government bonds in such scenarios. This shift may indicate constraints in certain funding markets or heightened stress in mortgage-related assets.

China Adds Massive Liquidity Injection

In tandem, the People's Bank of China injected a remarkable 1.02 trillion yuan through seven-day reverse repo operations. The scale of this intervention highlights the coordinated pressure on global liquidity conditions, although the PBOC's actions appear primarily aimed at bolstering domestic market stability ahead of crucial economic data releases.

Market Implications and Warning Signs

The synchronized deployment of emergency measures by major central banks has sparked warnings about a developing global liquidity crisis. While these facilities are designed for periods of market stress, the current levels of engagement suggest more than just standard volatility.

The atypical collateral mix at the Fed's facility is particularly concerning. A move away from Treasuries—typically the most liquid and favored collateral—could signal dysfunction within the Treasury market itself or targeted pressure in the mortgage-backed securities sector.

Conclusion

These developments represent the most significant coordinated liquidity stress observed since the regional banking turmoil earlier this year. While the functions of central bank facilities appear to be operating as intended, the scale of intervention and unusual collateral dynamics indicate underlying tensions in the global financial ecosystem. Market participants are keenly attuned to whether these measures signify isolated stress or herald the onset of broader liquidity challenges.

Why It Matters

For Traders

The current liquidity measures suggest potential volatility ahead. Traders should consider these developments as signals of broader market instability, prompting risk assessment and management strategies.

For Investors

Long-term investors should watch for signs of systemic weakness that could affect asset valuations. The interventions may reveal underlying issues that could impact investment strategies moving forward.

For Builders

Developers should remain vigilant regarding market functionality. Understanding the implications of liquidity stress can help in making informed decisions about future projects and financing.