Lighter (LIT) Shows Resilience After Strong Market Debut

Lighter's native token, LIT, proves its resilience in the market post-airdrop, maintaining stability near $2.73. This performance indicates robust demand and effective distribution as traders turn their focus to the platform's fundamentals.

Key Takeaways

- 1## Early Trading Shows Resilience Lighter (LIT), the native token of a newly launched decentralized perpetuals exchange, has exhibited surprising stability after its initial market debut.

- 2Following the customary volatility associated with airdrop-driven token launches, LIT is currently trading around $2.

- 373, suggesting that the market is seeking equilibrium.

- 4## Post-Airdrop Market Dynamics The introduction of LIT to the market followed a widely seen distribution pattern within the cryptocurrency space, where eligible users received tokens through an airdrop mechanism.

- 5These launches often trigger immediate selling pressure as recipients rush to realize profits, typically resulting in sharp price declines shortly after the initial trading.

Early Trading Shows Resilience

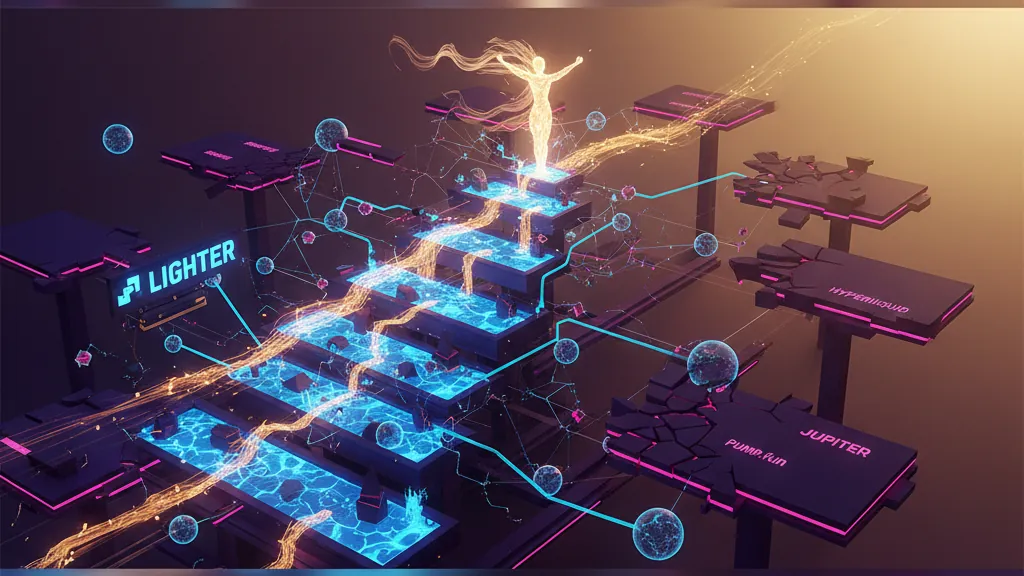

Lighter (LIT), the native token of a newly launched decentralized perpetuals exchange, has exhibited surprising stability after its initial market debut. Following the customary volatility associated with airdrop-driven token launches, LIT is currently trading around $2.73, suggesting that the market is seeking equilibrium.

Post-Airdrop Market Dynamics

The introduction of LIT to the market followed a widely seen distribution pattern within the cryptocurrency space, where eligible users received tokens through an airdrop mechanism. These launches often trigger immediate selling pressure as recipients rush to realize profits, typically resulting in sharp price declines shortly after the initial trading.

However, LIT's performance in the wake of its listing has surpassed market expectations. While the token did experience a slight retreat from its debut price, the extent of the dip has been notably less severe compared to similar launches. This relative stability hints at stronger-than-anticipated demand or effective token distribution strategies that have managed to dampen early selling pressure.

Finding Market Balance

As LIT continues to establish itself in the competitive decentralized exchange landscape, the current price level near $2.73 seems to indicate an early consolidation phase. The token is transitioning from its airdrop-driven debut into a phase of organic price discovery, where its market valuation will increasingly hinge on the platform's adoption, trading volume, and utility.

The perpetuals trading sector is witnessing significant growth within decentralized finance, with traders actively seeking alternatives to centralized platforms. Lighter’s entry into this space positions LIT not only as a governance token but also as a crucial utility token within its ecosystem. Yet, the long-term value proposition will ultimately depend on the exchange's success in attracting and retaining a user base.

Market Implications

The relatively controlled performance post-listing indicates several factors may be at play: a well-crafted tokenomics model, genuine interest from the trading community, or strategic market-making efforts. For potential investors and platform users, this stabilization period offers a valuable opportunity to evaluate the project's fundamentals free from the extreme volatility often accompanying new token launches.

As the dust settles from the initial airdrop event, market participants are closely monitoring whether LIT can sustain its current support levels and gain momentum based on the platform's fundamentals rather than initial launch excitement.

Why It Matters

For Traders

The current stability in LIT's price provides traders with a unique opportunity to engage with a promising decentralized exchange without succumbing to intense volatility.

For Investors

Long-term investors can assess LIT’s fundamentals during this consolidation period, potentially positioning themselves for future growth if the platform achieves significant adoption.

For Builders

Developers and builders in the DeFi space can take note of Lighter’s successful airdrop and initial stabilization as a blueprint for fostering user engagement and ensuring effective token distribution.