Poland's Parliament Approves Controversial Crypto Legislation Amid Outcry

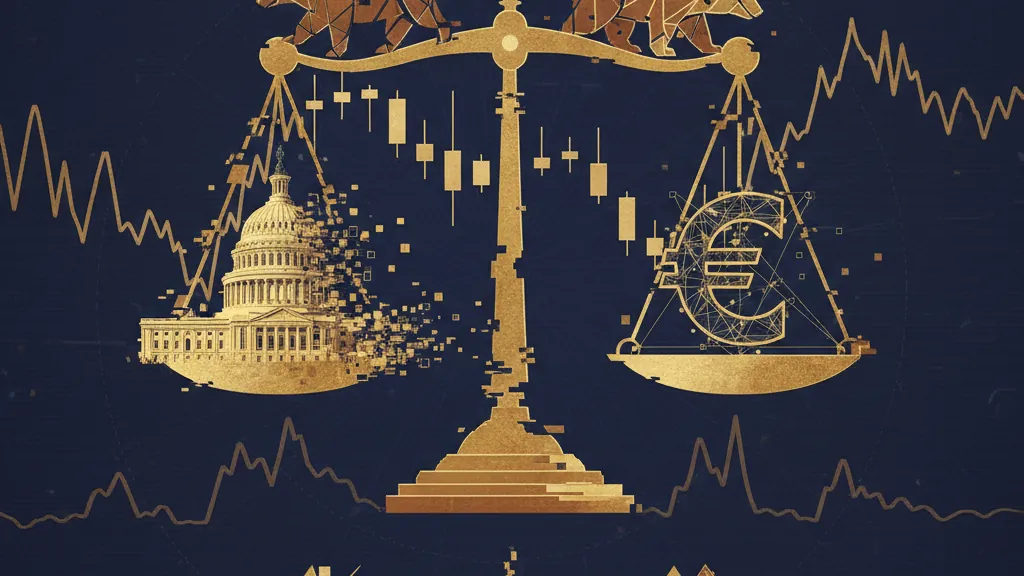

Poland's parliament has passed a contentious crypto bill that translates the EU's MiCA regulations into national law, igniting intense political and industry backlash. This legislation could reshape Poland's digital asset landscape significantly.

Key Takeaways

- 1# Parliament Approves Controversial Legislation Poland's parliament has approved a government-proposed cryptocurrency bill designed to implement the European Union's Markets in Crypto-Assets (MiCA) regulation at the national level.

- 2The bill, which has stirred significant controversy, marks a critical development in the country’s approach to digital asset regulation.

- 3## Political Discord Surrounds Implementation The passage of the bill has sparked intense political conflict, drawing both the head of state and opposition parties into the fray.

- 4This contentious legislative move highlights the complexities faced by European nations as they seek to translate EU-wide regulatory frameworks into effective national laws, particularly amid the rapid evolution of the cryptocurrency sector.

- 5While specific details of the disagreements remain at the heart of ongoing debates, the involvement of high-level government officials underscores the regulatory measure's significance and its potential ramifications for Poland's financial landscape.

Parliament Approves Controversial Legislation

Poland's parliament has approved a government-proposed cryptocurrency bill designed to implement the European Union's Markets in Crypto-Assets (MiCA) regulation at the national level. The bill, which has stirred significant controversy, marks a critical development in the country’s approach to digital asset regulation.

Political Discord Surrounds Implementation

The passage of the bill has sparked intense political conflict, drawing both the head of state and opposition parties into the fray. This contentious legislative move highlights the complexities faced by European nations as they seek to translate EU-wide regulatory frameworks into effective national laws, particularly amid the rapid evolution of the cryptocurrency sector.

While specific details of the disagreements remain at the heart of ongoing debates, the involvement of high-level government officials underscores the regulatory measure's significance and its potential ramifications for Poland's financial landscape.

Industry Pushback

In response to the legislation, the cryptocurrency industry has voiced strong criticism, asserting that the bill poses a considerable threat to operations within Poland. Various stakeholders have expressed concerns about the implications of local MiCA rule implementations, particularly those provisions that have become focal points of public discourse.

Industry insiders warn of potential compliance burdens, operational restrictions, and regulatory requirements that could surpass the baseline standards established by the overall MiCA framework. The negative reception from these players could indicate a struggle for the sector to adapt to an increasingly stringent regulatory environment.

Implications for Poland's Crypto Sector

The approval of this legislation signals a pivotal juncture for Poland's cryptocurrency market. As one of the European Union member states pioneering the domestication of MiCA regulations, Poland's implementation strategy could serve as a bellwether for other nations grappling with similar frameworks.

The combination of political strife and industry opposition raises pertinent questions about the bill's practical implementation and the potential for future amendments. The legislation’s ultimate impact will hinge on how regulatory authorities enforce its provisions and whether the concerns raised by industry participants prompt modifications.

Conclusion

Poland's adoption of this controversial crypto bill illustrates the intricate balance between EU regulatory harmonization and national legislative initiatives. As the legislation progresses despite substantial opposition, its effects on Poland's cryptocurrency ecosystem will be scrutinized closely by both industry participants and other EU member states navigating similar regulatory transitions.

Why It Matters

Traders

For traders, the legislation presents a potentially turbulent environment. Increased compliance demands may lead to volatility in crypto assets, requiring traders to stay informed and agile in response to new regulations.

Investors

Long-term investors should consider the implications of stricter regulations on market dynamics and participant behavior. The evolving regulatory landscape may influence investment strategies and asset valuations within Poland's crypto market.

Builders

Developers and builders in the crypto space must adapt to the new regulatory framework, which could shape technological innovations and operational strategies. Understanding the compliance landscape will be crucial for future projects and initiatives.