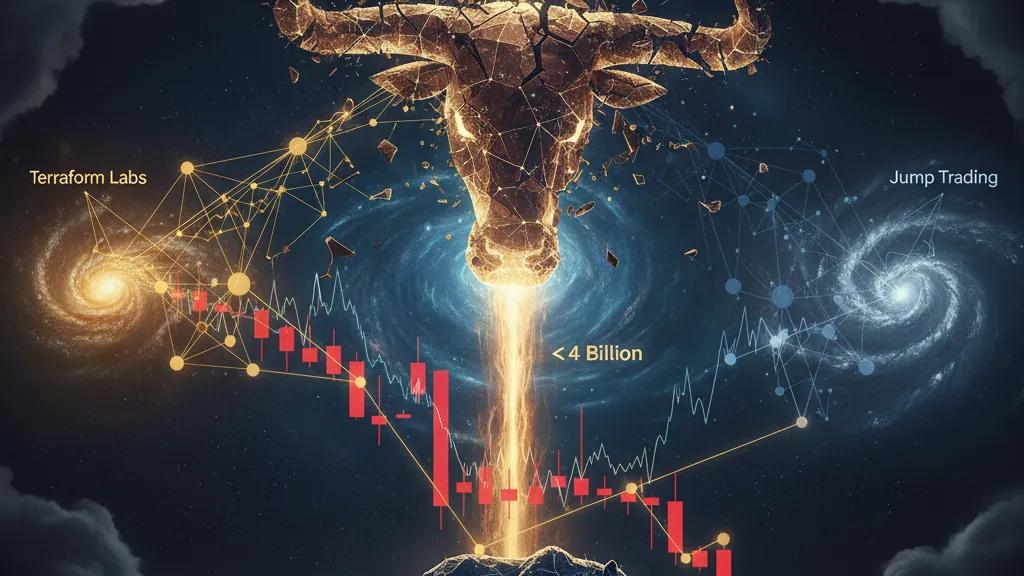

Terraform Labs Files $4 Billion Lawsuit Against Jump Trading Over Terra Collapse

Terraform Labs has launched a landmark lawsuit against Jump Trading, seeking $4 billion in damages linked to the catastrophic failure of the Terra ecosystem. This case could redefine liability standards for trading firms within the cryptocurrency space.

Key Takeaways

- 1## Major Legal Action Targets Proprietary Trading Firm Terraform Labs' administrator has filed a monumental lawsuit against Jump Trading, demanding $4 billion in damages related to the catastrophic collapse of the Terra ecosystem in 2022, according to a report by the Wall Street Journal.

- 2## Details of the Lawsuit The legal action alleges that Jump Trading, a prominent proprietary trading firm, played a significant role in contributing to Terra's ultimate collapse.

- 3The lawsuit claims that the firm profited illegally from the disintegration of the blockchain ecosystem, which once boasted a market capitalization in the billions.

- 4This $4 billion claim represents one of the largest legal actions arising from the Terra collapse, a事件 that sent shockwaves through the cryptocurrency markets and resulted in estimated losses of over $40 billion for investors worldwide.

- 5## Background on the Terra Collapse Founded by Do Kwon, the Terra ecosystem experienced a catastrophic failure in May 2022 when its algorithmic stablecoin, UST, lost its peg to the U.

Major Legal Action Targets Proprietary Trading Firm

Terraform Labs' administrator has filed a monumental lawsuit against Jump Trading, demanding $4 billion in damages related to the catastrophic collapse of the Terra ecosystem in 2022, according to a report by the Wall Street Journal.

Details of the Lawsuit

The legal action alleges that Jump Trading, a prominent proprietary trading firm, played a significant role in contributing to Terra's ultimate collapse. The lawsuit claims that the firm profited illegally from the disintegration of the blockchain ecosystem, which once boasted a market capitalization in the billions.

This $4 billion claim represents one of the largest legal actions arising from the Terra collapse, a事件 that sent shockwaves through the cryptocurrency markets and resulted in estimated losses of over $40 billion for investors worldwide.

Background on the Terra Collapse

Founded by Do Kwon, the Terra ecosystem experienced a catastrophic failure in May 2022 when its algorithmic stablecoin, UST, lost its peg to the U.S. dollar. This de-pegging initiated a death spiral that annihilated the value of LUNA, Terra's native token, effectively erasing the entire ecosystem within just days.

Do Kwon has been embroiled in legal troubles, facing criminal charges in multiple jurisdictions. He was arrested in Montenegro in 2023 and is currently facing extradition requests from both the United States and South Korea.

Implications for the Industry

This lawsuit underscores the ongoing legal ramifications stemming from one of cryptocurrency's most significant failures. Actions against firms like Jump Trading indicate that regulators and administrators are not only targeting the direct architects of failed projects but are also scrutinizing market participants who may have profited from their collapse.

The case could set crucial precedents regarding the responsibilities and liabilities of trading firms operating in the cryptocurrency markets, especially those wielding significant market influence.

Conclusion

As the legal proceedings surrounding the Terra collapse evolve, this lawsuit introduces yet another chapter in the aftermath of the ecosystem's failure. The outcome may have wide-reaching implications for how trading firms interact with cryptocurrency projects and their accountability in the event of project failures. The cryptocurrency community will undoubtedly be watching closely as this case progresses through the courts.

Why It Matters

Traders

For traders, this lawsuit emphasizes the risks involved in trading ecosystems with controversial histories. Outcomes could influence market sentiment and regulation moving forward.

Investors

Long-term investors should be aware that the implications of this case may affect how legal frameworks operate within the cryptocurrency space, potentially safeguarding their interests against future mishaps.

Builders

Developers and builders should take note of the potential shifts in liability and responsibility within the market, as the need for clearer guidelines and protections becomes more apparent in light of such high-profile legal actions.