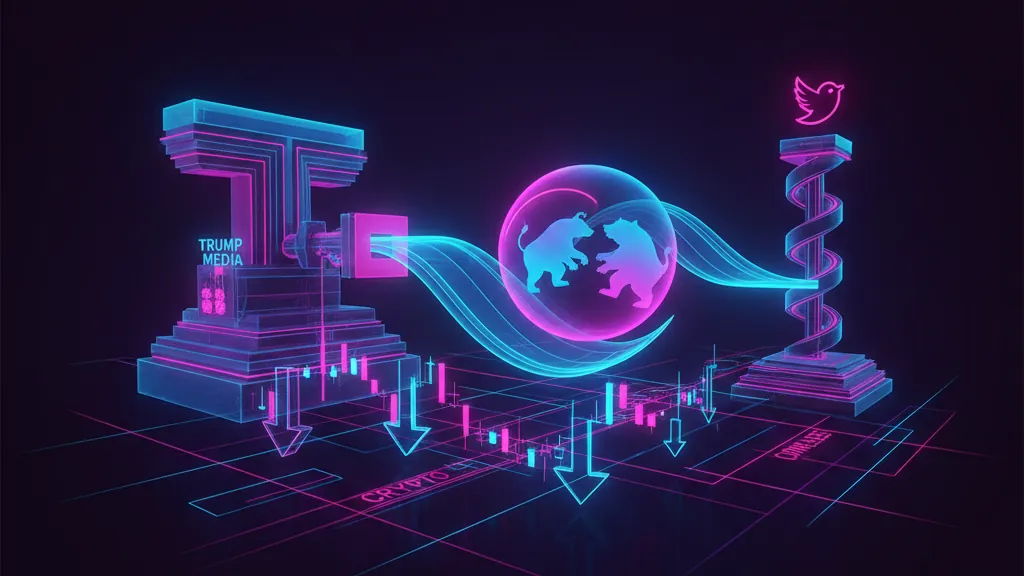

Trump Media Launches Five NYSE ETFs Under Truth Social Brand

Trump Media & Technology Group has launched five exchange-traded funds (ETFs) under the Truth Social brand on the NYSE, expanding its financial offerings. These funds aim to appeal to investors valuing domestic industries and conservative economic principles.

Key Takeaways

- 1## Trump Media Expands Financial Offerings with NYSE-Listed ETFs Trump Media & Technology Group has officially launched five exchange-traded funds (ETFs) under the Truth Social brand, marking a significant expansion of the company's financial product portfolio.

- 2The funds commenced trading on the New York Stock Exchange (NYSE), representing a pivotal moment in the convergence of media and investment vehicles.

- 3## Details of the Launch The five Truth Social-branded ETFs are now trading on the NYSE, one of the world's largest and most prestigious stock exchanges.

- 4This debut provides investors structured exposure to investment strategies aligned with the Truth Social ethos, diversifying Trump Media's offerings beyond its core social media platform.

- 5This launch signifies a notable development in the ETF marketplace as media and technology companies increasingly explore financial services as complementary business lines.

Trump Media Expands Financial Offerings with NYSE-Listed ETFs

Trump Media & Technology Group has officially launched five exchange-traded funds (ETFs) under the Truth Social brand, marking a significant expansion of the company's financial product portfolio. The funds commenced trading on the New York Stock Exchange (NYSE), representing a pivotal moment in the convergence of media and investment vehicles.

Details of the Launch

The five Truth Social-branded ETFs are now trading on the NYSE, one of the world's largest and most prestigious stock exchanges. This debut provides investors structured exposure to investment strategies aligned with the Truth Social ethos, diversifying Trump Media's offerings beyond its core social media platform.

This launch signifies a notable development in the ETF marketplace as media and technology companies increasingly explore financial services as complementary business lines.

Market Positioning and Investment Focus

These new investment vehicles are designed to shape emerging investment trends, focusing specifically on domestic industries and conservative economic principles. This strategic positioning may resonate with investors looking to align their portfolios with particular economic philosophies.

By concentrating on American-based companies and sectors, the ETFs tap into a growing trend of economically nationalist investment strategies that have gained traction in recent years. This emphasis may not only attract conservative investors but also drive significant capital toward U.S. markets.

Implications for the Investment Landscape

The introduction of these ETFs by Trump Media has several implications for the financial markets. First, it may attract a unique investor demographic seeking products that explicitly align with conservative values. Second, the focus on domestic industries could significantly increase attention on U.S.-based sectors and companies.

Ultimately, the success of these funds will depend on various factors, including investment performance, expense ratios, and their ability to stand out in a saturated ETF marketplace offering thousands of options.

Conclusion

Trump Media's launch of five Truth Social ETFs on the NYSE represents a strategic foray into the financial services sector. By offering investment products that emphasize domestic industries and conservative values, the company positions itself at the intersection of media, technology, and finance. The reception of these ETFs will provide valuable insights into investor interest in values-aligned investment vehicles and may influence other media companies in their approach towards financial product development.

Why It Matters

For Traders

Traders may find unique opportunities in these ETFs due to their alignment with conservative economic values, which might attract a specific investor segment and lead to increased volatility.

For Investors

Long-term investors interested in aligning their portfolios with domestic, conservative-driven investment strategies may benefit from these newly launched ETFs, which could reflect broader economic trends.

For Builders

Developers and industry builders should watch how the integration of media and finance evolves, as this could inspire new financial technologies or platforms aimed at values-based investments.